A balance sheet is one of the most crucial financial statements that any business, big or small, needs to manage effectively. It gives a snapshot of a company’s financial health at a specific point in time. For businesses in Puerto Rico, understanding and maintaining a well-organized balance sheet is key to ensuring smooth accounting management and long-term financial success.

What is a Balance Sheet?

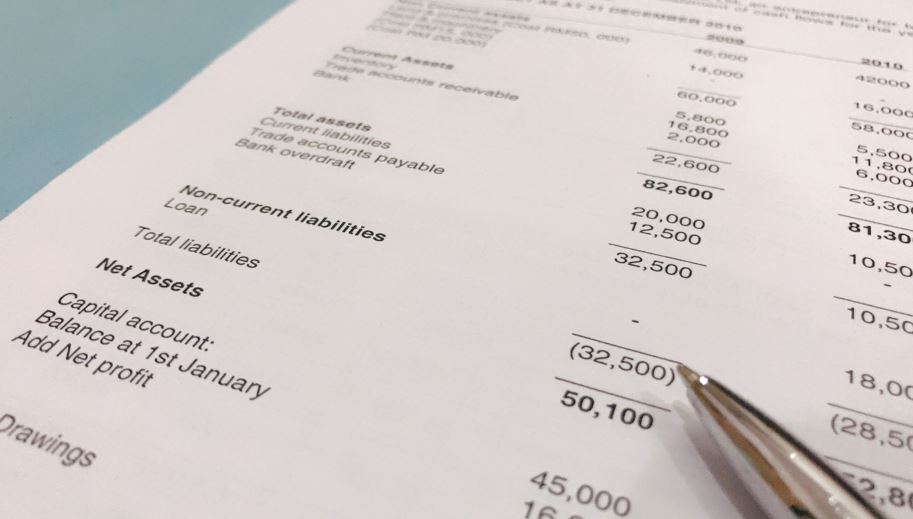

A balance sheet is a financial report that overviews a company’s assets, liabilities, and equity. It’s divided into two main sections: the left lists assets, while the right lists liabilities and owner’s equity. The idea is that a company’s assets must always equal the combined total of its liabilities and equity. This fundamental equation is:

Assets = Liabilities + Equity

By regularly reviewing the document, businesses can gain a clearer picture of their financial standing, which helps them make informed decisions.

Importance in Accounting Management

For businesses in Puerto Rico, an organized balance sheet is vital for various reasons:

- Financial Health Check: A well-maintained financial statement allows businesses to assess their overall health. It reveals whether the company is over-leveraged or has enough assets to cover its debts. This is especially crucial for business owners and managers who need to make key decisions regarding expansion, investments, and operational changes.

- Access to Credit: Lenders often request a company’s financial reports before offering loans or credit lines. A strong financial position signals stability, making it easier for businesses to secure financing when necessary.

- Tax Preparation: Accurate financial records are essential for precise tax reporting. By understanding their financial status, business owners in Puerto Rico can ensure compliance with tax obligations while maximizing deductions and credits.

- Investor Confidence: Investors heavily rely on financial statements to evaluate the health of a business. Strong financial records can attract investors, while weak ones may raise concerns about the company’s viability.

- Planning and Forecasting: Up-to-date financial statements are crucial for forecasting future growth. They enable better budgeting and financial planning, helping businesses remain profitable and avoid unnecessary risks.

Key Components

Understanding financial statements is essential for business owners in Puerto Rico. These statements consist of three main components:

- Assets: These are resources owned by the company that are expected to provide future economic benefits. Assets are typically divided into current and non-current categories. Current assets include cash, accounts receivable, and inventory, which are expected to be converted into cash within a year. Non-current assets include long-term investments and property, plant, and equipment.

- Liabilities: Liabilities represent the company’s obligations to third parties. They are also divided into current and non-current categories. Current liabilities include accounts payable, short-term loans, and accrued expenses, while non-current liabilities include long-term debt and deferred tax liabilities.

- Equity: Equity represents the owner’s claims on the business after all liabilities have been deducted from assets. It includes invested capital, retained earnings, and other reserves. The equity section of the balance sheet indicates the company’s net worth.

How to Create and Maintain an Accurate Balance Sheet

Creating a financial statement may seem like a daunting task, but it doesn’t have to be. Here are some tips to help businesses in Puerto Rico create and maintain accurate records:

- Keep Detailed Records: It’s crucial to track all financial transactions. Accurate record-keeping ensures that your financial statement reflects the true state of your business. Consider investing in accounting software or hiring a professional to help manage your records.

- Review Regularly: Financial statements should be updated regularly to ensure accuracy. Monthly reviews are ideal for keeping your financial data current and spotting potential issues early.

- Consult with an Accountant: If you’re unsure about creating or interpreting your financial statements, it’s worth consulting a certified accountant. They can provide professional insight and ensure your reports are in order.

- Use the Financial Records for Decision Making: Regularly reviewing your financial statement provides valuable insights into your company’s strengths and weaknesses. Use this information to make strategic decisions, such as expanding operations, cutting costs, or seeking additional funding.

How a Balance Sheet Helps with Business Growth in Puerto Rico

In Puerto Rico, maintaining accurate financial statements can be the difference between business success and failure. When you understand your assets, liabilities, and equity, you can make informed decisions that drive your business forward. Whether you are a small business owner or managing a large corporation, knowing how to create, manage, and analyze your financial statements is a critical skill.

A well-organized financial statement gives you clarity on whether your business has the resources to invest in growth opportunities, pay off debt, or cover other financial obligations. Additionally, it helps in setting realistic goals and strategies for improving your company’s financial position.

Conclusion

The balance sheet is not just a technical accounting tool – it’s a strategic asset for managing your business. By creating and maintaining an accurate document you gain insights into the financial health of your company, make informed decisions, and ensure long-term success. For businesses in Puerto Rico, a solid understanding is an essential part of efficient accounting management.

If you’re ready to take control of your business’s financial future, contact ASGC today. Our expert accountants can help you create and maintain accurate financial records to support your business goals.